Choosing an OLAP Engine for Financial Risk Management: What To Consider?

DZone

AUGUST 16, 2023

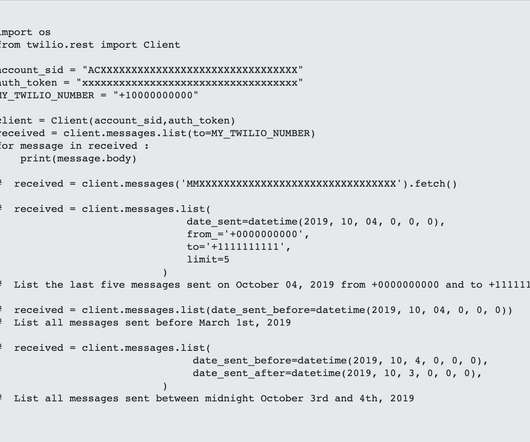

Data Must Be Combined The financial data landscape is evolving from standalone to distributed, heterogeneous systems. For example, in this use case scenario, the fintech service provider needs to connect the various transaction processing (TP) systems (MySQL, Oracle, and PostgreSQL) of its partnering banks.

Let's personalize your content